- aofsoman@omantel.net.om

- +968 24724700

MANAGEMENT DISCUSSION AND ANALYSIS REPORT

OVERVIEW

Al Omaniya Financial Services (AOFS) has completed 28 years of successful operations as a Non-Banking Financial Institution, offering a comprehensive range of financial products. Over its tenure of more than two and half decades, the company has established a strong market presence with robust systems and processes and has crossed many significant milestones. The following discussion and analysis provide information that the management believes, is useful in understanding AOFS’s operating results and financial position. The discussion is based on AOFS’s continuing operations and should be read in conjunction with our consolidated financial statements and related notes appearing elsewhere in this report. Certain statements in the MD&AR describing the company’s views, objectives, projections, estimates, expectations, etc. may be extrapolative within the ambit of applicable laws and regulations. Actual results could differ materially from those expressed or implied. Important factors like changes in government regulations, tax laws, interest rates in the domestic and international markets, demand and supply of capital goods, etc. may influence the company’s operating results.

WORLD ECONOMIC OUTLOOK

The year 2025 marks the end of the first quarter of the twenty-first century and the last 25 years have been transformative for emerging economies whose ascendance was powered by swift global trade and financial integration. These economies now account for about 45% of global GDP, up from 25% in 2000, a trend driven by robust collective growth in the three largest EMDEs—China, India, and Brazil. Domestic reforms and a benign global environment have allowed many low-income countries to graduate to middle income status in the first decade of the twenty first century. Global growth is rebounding as inflation returns closer to targets and monetary easing supports activity in both advanced economies and emerging market and developing economies and the World Bank has projected the growth rate to hold steady at 2.7 percent in 2025-26. As the first quarter of the twenty-first century concludes, the primary challenge facing policy makers is to sustainably raise growth rates and put a wide range of development objectives on a better trajectory amidst significant challenges like geopolitical tensions and high public debt ratios. Enhanced international cooperation is needed to address growing trade fragmentation and limit its damage and to tackle climate change and biodiversity loss, mounting food insecurity, and conflict.

DOMESTIC ECONOMY

Oman’s economy has experienced notable growth, underpinned by ongoing efforts to diversify sources of income, enhance non-oil revenues, and stimulate private sector participation. These reforms have translated into significant improvements in the country’s economic performance, with the government working steadfastly to reduce the fiscal deficit, promote sustainable financial stability, and boost overall productivity. The government launched a mediumterm financial plan (2020-2024), which focused on rationalising spending, broadening government revenue sources, and strengthening social protection mechanisms. The success of these initiatives has laid strong foundations for achieving long-term fiscal sustainability.

Several significant strategic projects have been initiated to boost the country’s economic development. These projects have not only attracted domestic and foreign investments but have also strengthened Oman’s position as a global investment destination. There has been commendable decline in public debt because of rigorous fiscal measures, including enhanced efficiency in public spending and increase in non-oil revenues, compounded by higher oil prices and gas production.

The banking sector remains sound with ample capital coupled with the continued efforts of the Central Bank of Oman in strengthening regulatory and supervisory frameworks. The country’s credit ratings have improved notably over the past few years, reflecting positive economic developments, underscoring investor confidence in Oman’s economic management and growth trajectory.

OPPORTUNITIES AND THREATS

Oman’s journey toward 2025 is guided by its ambitious Vision 2040, a comprehensive blueprint for economic transformation. This transition is supported by bold reforms and strategic initiatives that are reshaping the country’s economic landscape. Oman’s ‘In-Country Value’ program seeks to enhance the nation’s economy by promoting local sourcing, developing the skills of the Omani workforce, and stimulating productivity. This presents opportunities for businesses to participate in local supply chains, invest in training and development, and contribute to Oman’s economic growth. Oman’s focus on economic diversification opens doors for investments in non-oil sectors such as tourism, logistics, manufacturing, renewable energy, and fisheries. The Duqm SEZ (Special Economic Zone) exemplifies this strategy by fostering manufacturing, logistics, and tourism.

Oman is investing heavily in renewable energy to diversify its energy mix and foster sustainable development. Key projects include large-scale solar farms in Ibri and wind energy installations in Dhofar.

The company has over the years, planned the necessary human resources, enhanced the capital base and is continuously seeking to upgrade and develop IT system to address the need of the hour. The Company has upgraded its security aspects, upgraded its hardware infrastructure and database and is in the final stage of diversifying its distribution channel through Mobile APP.

The company has over the years, planned the necessary human resources, enhanced the capital base and is continuously seeking to upgrade and develop IT system to address the need of the hour. The Company has upgraded its security aspects, upgraded its hardware infrastructure and database and is in the final stage of diversifying its distribution channel through Mobile APP.

The company follows a prudent provisioning policy. The NPA coverage is more than 500% (including the specific reserve for non-performing assets) which will help the company to tide over any unforeseen losses. The company shall continue to maintain its provisioning stance subject to behaviour of the debt.

The company is proactive, confident, and properly geared up to meet challenges and exploit available opportunities for a profitable and sustainable growth both in the short as well as long run without compromising on the asset quality.

PRODUCT WISE PERFORMANCE

The company with its existing product lines of Project funding,Working capital funding, Asset financing, Bills discounting and Debt factoring, including its ‘Lifeline’ and ‘Lifestyle’ segmentshas managed to maintain its assets modestly.

The retail asset financing product under the brand name ‘Lifeline’ offers a variety of specialised finance products for the self-employed, salaried individuals, transport operators, small and large businesses, etc. The ‘Lifestyle’ loan segment (micro credit program) continues to do exceedingly where the company has a good network through its branches and employer tie-ups.

Our service has the unique attributes of speed, transparency, quick response, empathy, understanding customer concerns and ethical fair practices. We endeavour to build products and services around customer needs. Our deliverables of simple documentation, quick credit approvals, competitive interest rates and other value-added services have created a large, satisfied clientele for the company.

BUSINESS CONTINUITY PLAN

Based on the Board approved Business Continuity Plan (BCP), and based on Business Impact analysis, the company has tested the BCP successfully from its BCP site at Nizwa on the 04th December 2025.

The company has the necessary BCP set up at its alternate site at Nizwa and back up and disaster recovery operations for its IT Systems were tested and found robust. The company has the capacity to continue major operational activities in the unfortunate event of major disruptions with minimum down time.

CYBER SECURITY

In line with CBO guidelines and directives from the Board, the company has successfully implemented the Cyber Security & Resilience Framework and obtained a Certificate of Compliance following an independent security audit, achieving a satisfactory Cyber Security Maturity Model score.

Robust cybersecurity controls have been established to mitigate emerging threats and vulnerabilities, with key indicators in place to monitor, evaluate, and drive continuous improvements in cybersecurity resilience.

FINANCIAL CONSUMER PROTECTION REGULATORY FRAMEWORK (FCPRF)

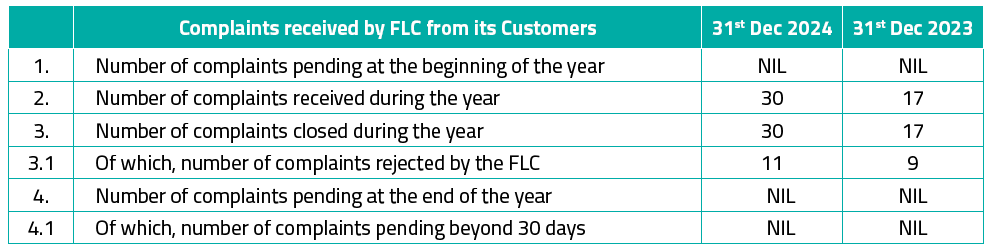

The Company has adopted the FCPRF and has made necessary changes in the policy manuals and processes. For financial education & awareness, for the rights and responsibilities of consumers and for lodging of queries/ complaints, the Company’s website can be referred to. The broad status of Financial Consumer Protection Regulatory Framework (FCPRF) regarding customer complaints and redressal are as below: Disclosure on customer complaints and redressal:

RISKS AND CONCERNS

Managing risks means understanding the static and dynamic risks involved in our businesses and assessing the potential impacts and likelihood of each risk. The overall risk governance framework of the company includes strong corporate oversight, independent internal audit function and well laid down policies and processes. The company is exposed to strategic risk, credit risk, liquidity risk and interest rate risk.

STRATEGIC RISK

Strategic risk is the potential for loss arising from ineffective business strategies, the absence of integrated business strategies, the inability to implement integrated business strategies, and the inability to adapt the strategies to changes in the business environment.

The company’s overall strategy is established and approved by the Board in consultation with the Management and the Senior Executive Team. The most significant strategic risks faced by the company are identified, assessed, managed, and mitigated by Senior Management, with oversight by the Board.

CREDIT RISK

Credit risk is the risk that one party to a financial instrument will fail to discharge an obligation and will cause the other party to incur a financial loss. The company attempts to control credit risk by setting limits for individual borrowers, monitoring credit exposures, limiting transactions with specific counter parties, and assessing continually the creditworthiness of counter parties.

The default risk for the company is at an acceptable level. The company has substantially low NPA levels and highest NPA Coverage in the industry.

LIQUIDITY RISK

Liquidity risk is the risk that the company will be unable to meet its liabilities as and when they fall due. The business of lending has an inherent risk of liquidity arising from the mismatch of tenure of funds borrowed vis a vis lent, in addition to unforeseen adverse recovery patterns.

To limit the liquidity risk, the Management through their carefully drawn up strategies, resorts to diversified sources of funds, avoids undue concentration on a single lender, periodically reviews cash flows and manages its collection in a systematic manner. The company has taken appropriate treasury management actions to effectively optimise the cost of funds for 2024. The company has built up deposits over past several years and the deposits are placed with local commercial banks which provide ample liquidity buffer for effective treasury management. Apart from the asset side, on the liability side, in 2024 the company has mobilised fresh Corporate Deposits and a 4 year USD Term Loan of USD with semi-annual repayment starting from the 30th month from the drawdown.

INTEREST RATE RISK

Interest rate risk arises from the possibility that changes in interest rates will affect future profitability or the fair values of financial instruments. The company is exposed to interest rate risk as a result of mismatches or gaps in the amounts of assets and liabilities and off-balance sheet instruments that mature or re-price in a given period. The company manages this risk by matching the re-pricing of assets and liabilities through risk management strategies. The company has recently mobilised a 4-year Term Loan of USD with Interest rate swap (IRS) to hedge any interest rate risk.

INTERNAL CONTROL AND ADEQUACY

The company believes that Internal Control is a necessary concomitant of the principle of governance and has made conscious efforts to instil effective Internal Control and processes.

The company has Board committees and Management committees, which are involved in strategic decision making, ensuring efficient and effective operations of the company and incorporating good corporate governance policies in line with the regulatory requirements.

The company has a well-defined organization structure, clearly defined authority levels well documented policies and guidelines approved by the Board and robust IT systems to ensure process efficiency.

The company has put in place a mechanism to minimize operational risk by way of effective Internal Controls, Systems Reviews and an on–going Internal Audit program. The company has an in-house Internal Audit department, and the internal auditor undertakes comprehensive audits and reports directly to the Audit Committee of the Board. The Audit Committee of the Board reviews the internal audit reports, the adequacy of the internal controls and reports on the same to the Board.

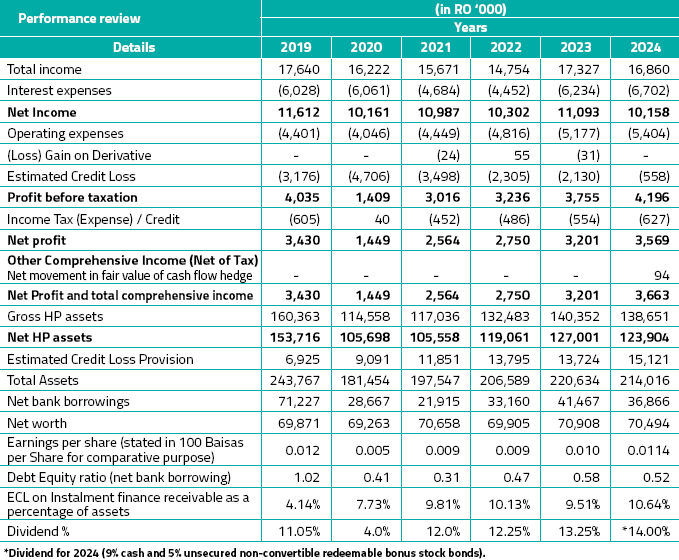

OPERATIONAL PERFORMANCE

The year 2024 was a year of steady modest growth for the world economy. The company managed to maintain its asset size and asset quality. Looking back, we take pride in the achievements of the company as a leading player in the industry in maintaining quality assets and lowest NPA. Today’s position has been achieved with careful planning and clear strategies, supported by sound vision and guidance by the Board. The company has successfully overcome the liquidity stress by maintaining a prudent mix of short-term vs long-term borrowing and ample liquidity buffer.

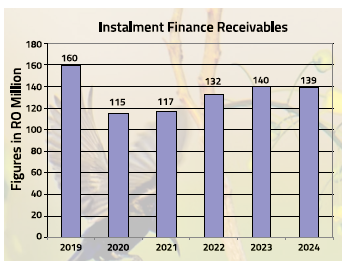

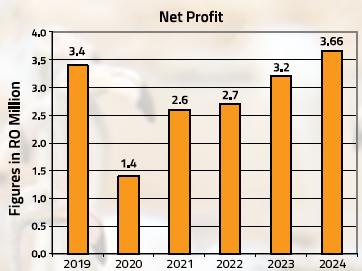

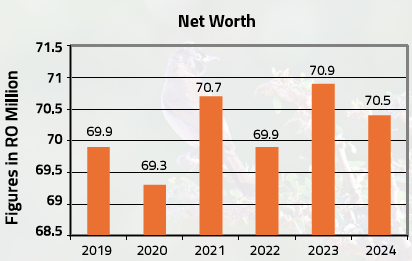

The non-performing loans of the company are under control and the company’s existing estimated credit loss level of RO 14.748 million (excluding ECL on deposits) is more than adequate. The non-performing assets coverage including the specific reserve for non-performing assets is more than 500%. The Loan Book stands at stands at RO 124 million at the year end. The company was able to register a net profit of RO 3.6 million for the year 2024 against RO 3.2 million for 2023. For all the regulatory purposes, the company’s net worth stands at RO 70.494 million. The Book Value / Net Asset Value of the company’s share stands at RO 0.215. The company has proposed a dividend of 14% for the year 2024. This would take the total pay-out since inception to 505.83%

HUMAN RESOURCES

Employees are a critical part of our competitive advantage. We have sound Human Resource policies, on and off the job training, counselling and a scientifically designed reward system, which helps us to create a dependable, highly skilled and motivated work force. During the year the company has increased its Omanisation percentage.

OUR CUSTOMER

AOFS is committed to delivering superior value through a powerful, distinctive branding which ensures better customer retention, better value and increased business with each customer. Our huge client base stands testimony to this fact.

CAPITAL STRUCTURE

The Company’s objective of the capital management is to ensure that it maintains healthy capital ratios in order to support its business and maximise shareholder value. The company manages its capital structure and makes adjustments to it in the light of changes in business conditions. No changes were made in the objectives, policies or processes during the current year.

The Company’s lead regulator Central Bank of Oman sets and monitors capital requirement as a whole. The Company’s current paid up capital is RO 31.542 million which is well above the regulatory requirement of RO 25 million. One of our existing convertible bonus stock bonds (listed in 2019) got converted to Equity Shares in 2024 leading to further Capital enhancement.

FUTURE OUTLOOK

The company has reached its healthy position in the industry today after undergoing many business cycles under challenging economic circumstances. The company has also capitalized every single growth opportunity with its enviable strengths namely,

- Sound and innovative capital structure.

- Sound and innovative capital structure.

- Superior service to its loyal customers.

- Novel and valuable integrated business model.

- Lesser delinquency ratio due to cautious lending and effective collection mechanism.

- Good provisioning for impairment.

- Timely product diversification.

- Consistent earnings.

- Highly automated IT real time systems and processes.

We remain focused on maintaining quality assets with the objective of consistent returns for all our stakeholders. Our priorities for the coming year are:

- Cautious lending policies in all existing product lines

- Products structuring & better packaging to suit the market demand.

- Manage liquidity and costs judiciously ensuring sustainable earnings and profitability.

- Offer superior delivery mechanism and personalised customer service to build customer loyalty and superior brand positioning.

- Our Mobile App named “Omaniya Finance” which is expected to be launched by the 2nd Quarter of year 2025 will act as a virtual branch where the customer can enquire for loan, get it approved, upload basic documents and place service requests.

From inception till date the company has been delivering on its commitment of increasing shareholders’ wealth in its relentless pursuit of excellence. Our endeavor is to constantly seek out new processes, products and efficiencies aimed at making things better for our customers. Our success is attributable to the dedication of our employees and our continued focus on keeping commitments to our stakeholders. The management continues to closely monitor economic conditions and indicators including interest rates, delinquency and capital markets. The sound guidance and encouragement from our Board of Directors has played a significant role in maintaining the asset quality and profitability. Our aim is to build on our heritage of success and to make AOFS an admirable and illustrious financial service provider for today and the next generation.